In what has become a small holiday around here, mid-to-late May means warmer weather, long weekends and the announcement of the following year's HSA contribution limits. And as you've probably guessed, we're not really good at discussing hot dogs.

On May 28, 2019, the IRS released Revenue Procedure 2019-25 its annual update, which explains the 2020 inflation-adjusted amounts for high deductible health plans (HDHPs)

As expected, incremental increases were applied to self-only and family coverage, right in line with the last few years' worth of adjustments (typically a $50 increase for self-only coverage, and $100 for family coverage).

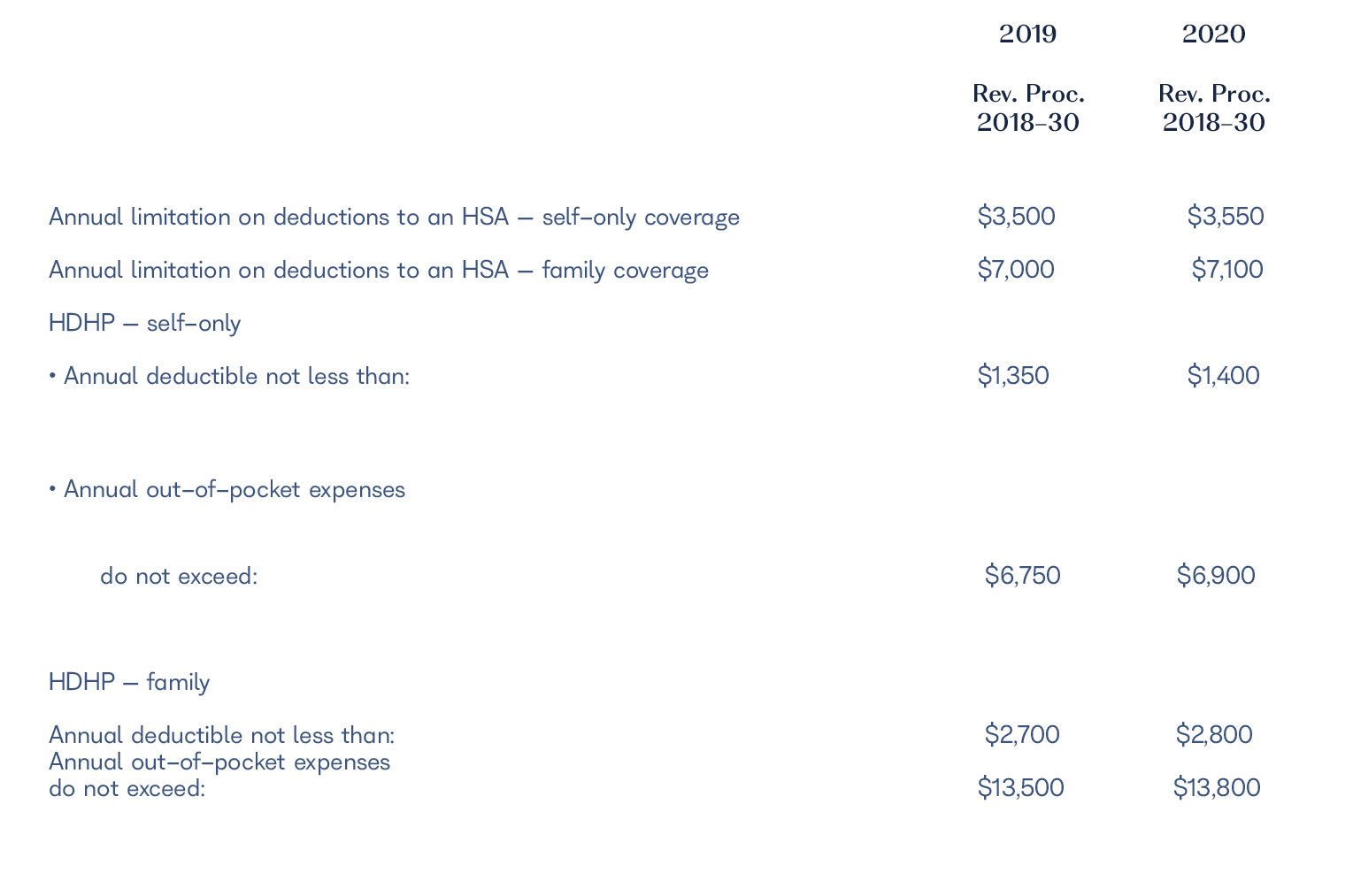

The HSA contribution limits for 2020 (as compared to this year) are as follows:

Remember! If you're 55 or older, you can contribute an additional $1,000 per year to the above totals as a catch-up contribution. This amount is unchanged from the previous year.

|

|