Is medical marijuana Flexible Spending Account (FSA) and Health Savings Account (HSA) eligible?

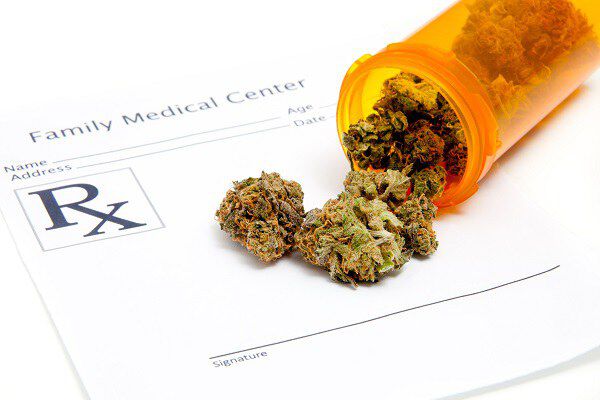

A common question we receive in our Learning Center from our customers relates to the flexible spending account (FSA) or health savings account (HSA) eligibility of medical marijuana. With the recent easing of state laws regarding the substance, it's easy to see why. While medical marijuana is still ineligible for reimbursement with flexible spending accounts, the general medical consensus around the drug has changed significantly in recent decades.

On November 5, 1996, California became the first state in the U.S. to legalize marijuana for medical use, and since then, similar laws have been passed in 38 states total. However, marijuana possession and use is still illegal under federal law and it is listed as a Schedule I drug.

Let's consider FSA/HSA eligibility and medical marijuana in more detail.

What is medical marijuana?

Medical marijuana is used to treat and lessen the severity of symptoms of disease. It can be smoked, inhaled or ingested in food or tea, as well as being available as a pill or oil. Depending on which state a person lives in, qualifying for this type of treatment requires meeting certain requirements and a specific qualifying condition. The most common conditions for which medical marijuana treatments are approved are Amyotrophic lateral sclerosis, Tourette Syndrome, epilepsy/seizures, multiple sclerosis , Crohn's disease, terminal illness, chronic pain and nausea and vomiting associated with cancer treatments.

Why isn't medical marijuana eligible?

At first glance, it may seem that medical marijuana would be eligible for reimbursement from an FSA or HSA because it is used to treat legitimate medical conditions. However any procedure, service, or item that is illegal under any law in effect where it is purchased or used is ineligible for reimbursement from an FSA. Medical marijuana continues to be listed as a Schedule 1 drug under federal law. Schedule 1 drugs are considered to have a high potential for abuse and to have no legitimate medical use. Therefore, regardless of some medical opinion to the contrary and its approval for medical use in some states, marijuana continues to be illegal under federal law for any purpose, including medical use.

IRS Publication 502, which lists eligible medical and dental expenses for tax deductions and reimbursements, specifically states that marijuana is not eligible under the “Controlled Substances" section, stating: “You can't include in medical expenses amounts you pay for controlled substances (such as marijuana, laetrile, etc.) that aren't legal under federal law, even if such substances are legalized by state law."

Even if federal law is changed to allow the use of medical marijuana, it would have to be dispensed and used in accordance with the varying rules and regulations of each state. For instance, New York allows medical marijuana only in 30-day, non-smokeable batches, whereas states like Connecticut allow users to hold up to 2.5 ounces at a time. Some states have designated dispensaries, or medical marijuana centers, where people must purchase the product.

Therefore, because marijuana is illegal under federal law everywhere in the United States, unless major changes come at the federal level in the coming years, medical marijuana will remain not eligible for reimbursement with consumer-directed healthcare accounts, despite state laws approving its use.

.png)